Split dollar life insurance accounting if you are looking for insurance for your home car or life then our insurance quotes service can give you quotes to help you find what you need. Collateral assignment split dollar life insurance arrangements are becoming more common in the credit union arena.

American International Group Wikipedia

American International Group Wikipedia

Think of split dollar life insurance as a win win strategy between two parties.

Split dollar life insurance accounting. Here you will find a definitive guide to the strategy including how and when it works the tax implications merits and obstacles and what your next steps should be. Split dollar life insurance plans are becoming popular among health care organizations because they offer tax advantaged retirement benefits and can qualify for loan accounting treatment. Split dollar life insurance plans are popular among credit unions seeking to retain and reward key executives.

One of many forms of deferred compensation benefits its an arrangement between the credit union and a key employee in which a life insurance policy is shared or split. Split dollar life insurance accounting if you are looking for the best insurance then our insurance quotes service can give you options to find a plan you are happy with. Loan treatment doesnt always apply.

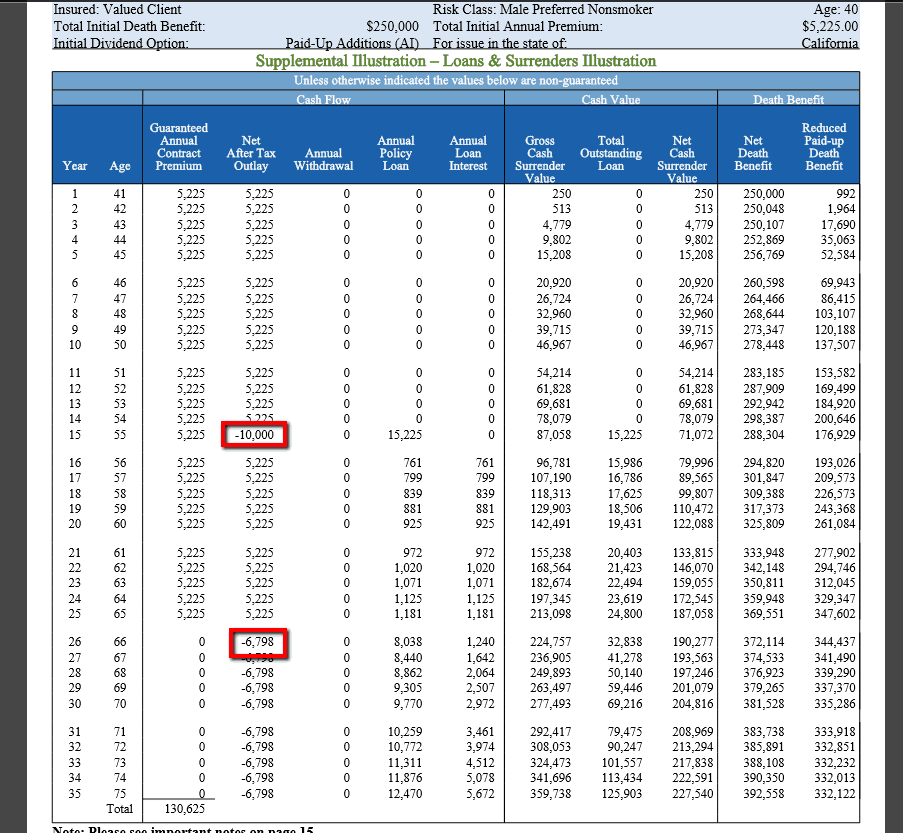

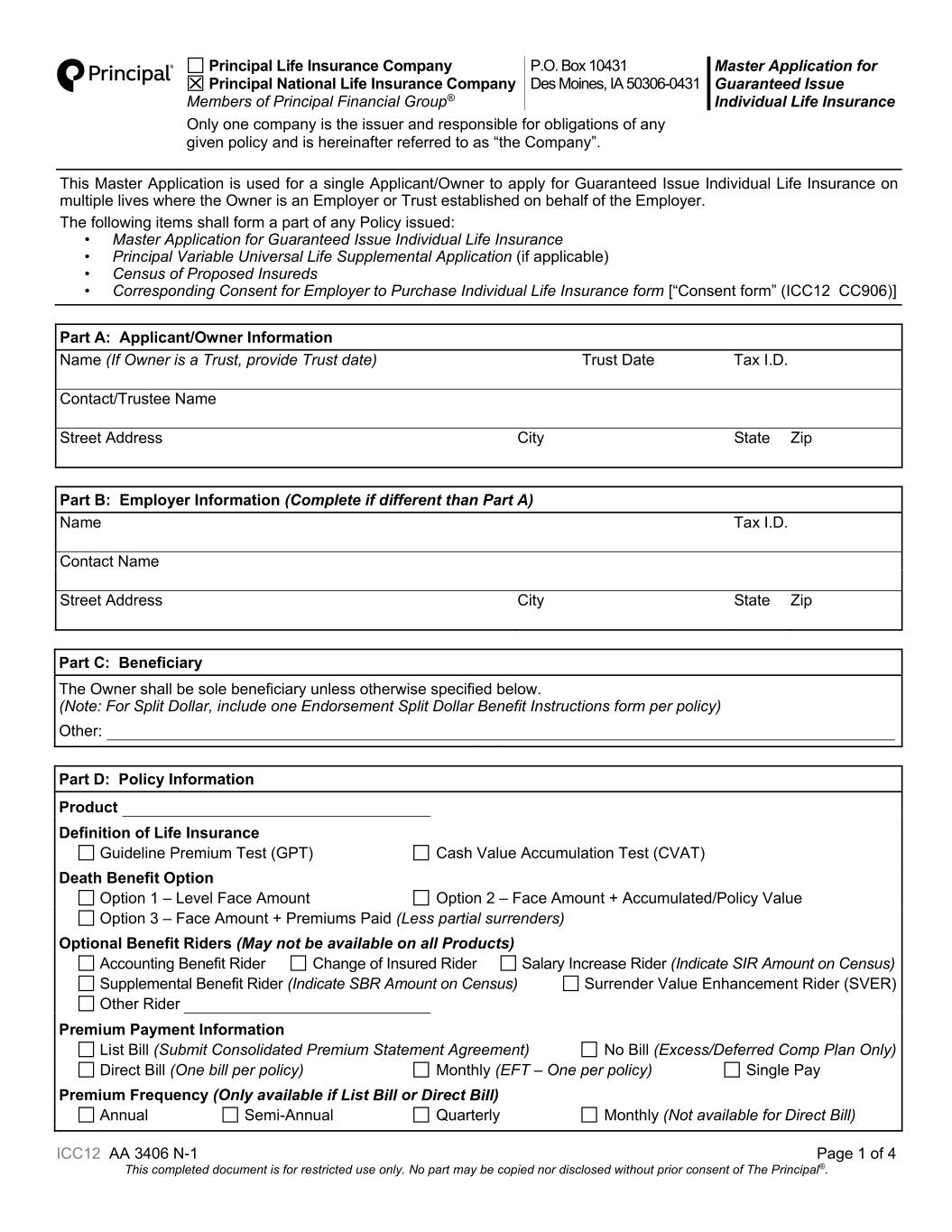

Given that sdli arrangements are not subject to the antidiscrimination rules applicable to qualified retirement and other types of. In a split dollar plan an employer and employee execute a written agreement that outlines how they will share the premium cost cash value and death benefit of a permanent life insurance policy. Split dollar life insurance is an arrangement between an employer and an employee to share the costs and benefits of a life insurance policy.

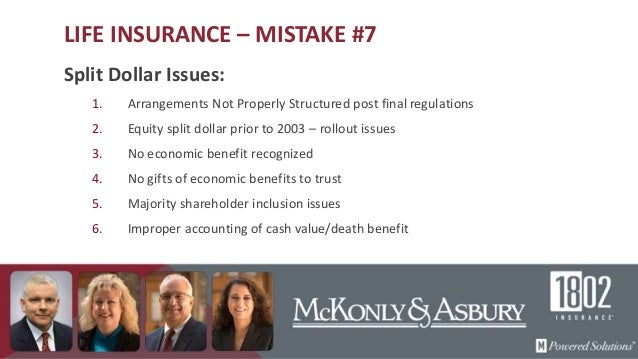

Nfp life is proud to present the comprehensive guide to split dollar life insurance nfp life has always sought to provide the most relevant and useful tools to its members and producers. Split dollar when properly set up is a mutually beneficial arrangement in which an owner and non owner split and share a life insurance contract. Convoluted nature of the rules controlling split dollar life insurance agreements there was no single source to turn to for answers until now.

The arrangement under which an employer and an employee share the costs and benefits of a cash value life insurance policy on the employees life is known as split dollar life insurance. The most popular format is collateral assignment split dollar where the credit. Specifically the parties join together to purchase an insurance policy on the life of the employee and agree in writing to split the cost of the insurance premiums as well as the policys death proceeds cash value and other benefits.

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

Pdf Life Insurance Cash Flows With Policyholder Behavior

Pdf Life Insurance Cash Flows With Policyholder Behavior

Corporate Owned Life Insurance

Corporate Owned Life Insurance

The Overwhelming Case Against Whole Life Insurance Above The Canopy

The Overwhelming Case Against Whole Life Insurance Above The Canopy

Http Moneyresourcesinc Com Documents Dollarflex Conceptual Overview Final Pdf

Fasb Emerging Issues Task Force Pdf Free Download

Fasb Emerging Issues Task Force Pdf Free Download

Https Sfmagazine Com Wp Content Uploads Historic 1990 1999 1995 02 Management Accounting V76 N8 Pdf

For The Record Newsletter From Andersen Q2 2018 Newsletter

For The Record Newsletter From Andersen Q2 2018 Newsletter

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

Acc 290 T Week 5 Apply Connect Exercise 2019 New 4

Acc 290 T Week 5 Apply Connect Exercise 2019 New 4

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

How To Offer Life Insurance As An Employee Benefit

How To Offer Life Insurance As An Employee Benefit

Life Insurance Trends Tips Review

Life Insurance Trends Tips Review

Usiness Exp Limit Method 1 Which Of The Fol Lowing Insurance

Fasb Emerging Issues Task Force Pdf Free Download

Fasb Emerging Issues Task Force Pdf Free Download

Sec Filing Amtrust Financial Services Inc

Bank Owned Life Insurance A Primer For Community Banks

Bank Owned Life Insurance A Primer For Community Banks

Navigating The Sarbanes Oxley Loan Prohibitions Alice Murtos

Navigating The Sarbanes Oxley Loan Prohibitions Alice Murtos

/GettyImages-114329820-f31a1e4ea99947d488b7d35cfe5bd1b8.jpg) How Split Dollar Life Insurance Works

How Split Dollar Life Insurance Works

Charitable Giving And Life Insurance Advico Advisory

Charitable Giving And Life Insurance Advico Advisory

0 Komentar untuk "Split Dollar Life Insurance Accounting"