These policies have become popular alternatives to long term care insurance. The death benefit can then be used to pay for long term care expenses.

Long Term Care Rider Pros And Cons Is It Worth It

Long Term Care Rider Pros And Cons Is It Worth It

This type of rider is similar to the accelerated death benefit which most life insurance policies have but the.

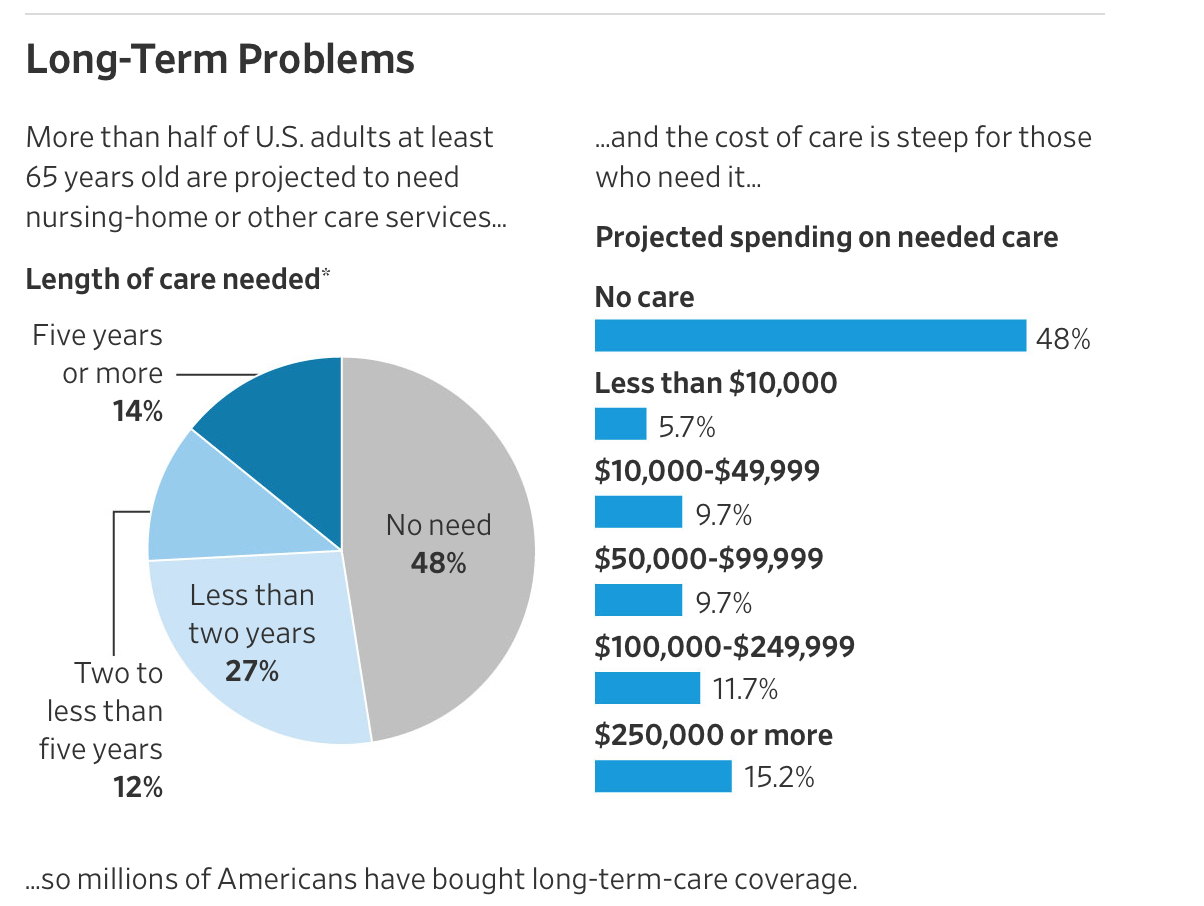

Term life insurance with long term care rider. And the best hybrid ltc insurance can provide advantages not found in other forms of long term health care insurance. A recent survey shows that as many as 70 of americans will require long term care at some point in their lives. A long term care ltc rider is a life insurance policy feature that allows you to receive a portion of the death benefit while you are still alive.

Youll need to keep paying enough in premiums to fund your policy or you could lose both your life insurance and long term care benefits. It wasnt that long ago that combination policies made up a small portion of the market with most people buying standalone policies. Long term care riders and cash value life insurance policies have another major advantage over term policies for people who have modest retirement savings.

If you or a loved one is on the verge of qualifying for medicaid coverage it may make sense to purchase a single fee whole life policy with a long term care rider. A long term care rider is a life insurance policy feature that allows you to get part of the death benefit from life insurance for long term care ltc needs while still alive. A form of accelerated death benefit adb long term care riders may offer you an opportunity to avoid financial strain from care needs.

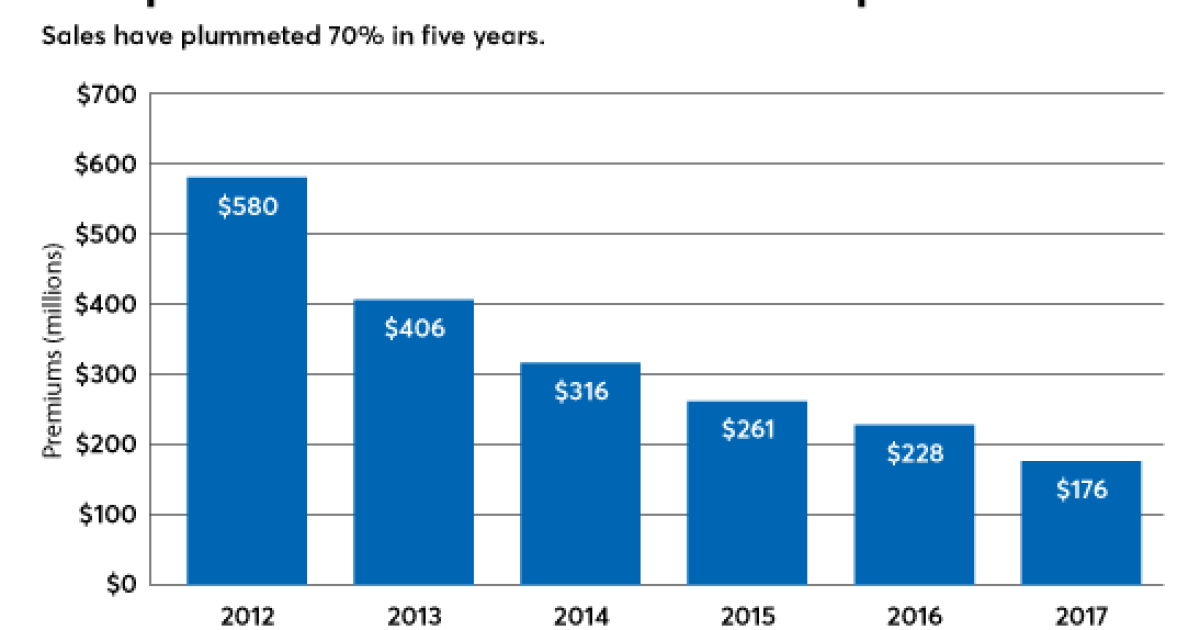

Another reason to consider including this benefit in your life insurance policy is that if you buy standalone long term care coverage and never need it. This type of long term healthcare protection combines life insurance with a long term care rider. Fewer than 100000 people purchased long term care insurance in 2016.

There are many types of insurances available to choose from which can be somewhat confusing. Because universal life insurance offers flexible premiums coverage lengths and death benefits adding a long term care rider is a little more complex. Universal life insurance with a long term care rider.

In this article well focus on the most ideal types of insurance for seniors. Life insurance with long term care rider. While standalone long term care insurance is often prohibitively expensive packaging a long term care rider into your life insurance policy can be far more cost effective.

This will help you understand better why acquiring life insurance for seniors with long term care rider is important and how elderly people can benefit from it. Should you consider buying life insurance with a long term care rider. Today life insurance policies with long term care riders are more popular than standalone long term care ltc insurance policies.

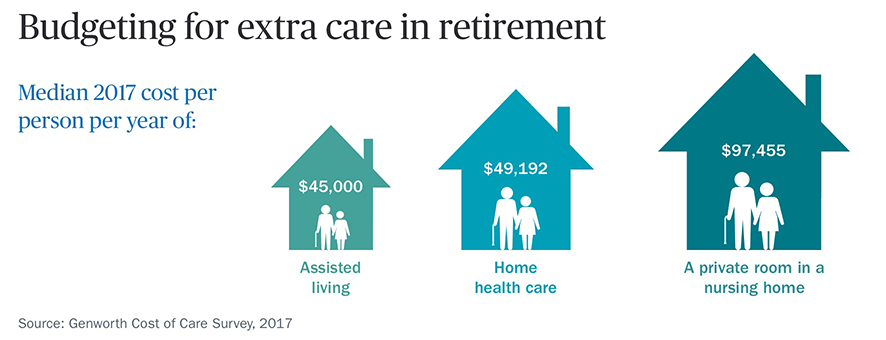

A long term care rider pays out a portion of your life insurance policys death benefit while youre still alive if you become too ill to take care of yourself and need to pay for assistance or care. Current costs for long term care facilities can run anywhere between 80000 150000 annually in a semi private or private nursing home.

The Marcus Agency On Twitter Like Ice Cream Long Term Care

The Marcus Agency On Twitter Like Ice Cream Long Term Care

Elder Care Planning Abs Agents

Elder Care Planning Abs Agents

Life Insurance With Long Term Care Benefits

Life Insurance With Long Term Care Benefits

Long Term Care Insurance Cost Ameriprise Financial

Long Term Care Insurance Cost Ameriprise Financial

Aarp Long Term Care Insurance Information

Aarp Long Term Care Insurance Information

Long Term Care Issues Facing Financial Advisors Financial Planning

Long Term Care Issues Facing Financial Advisors Financial Planning

Ensuring Your Path Solutions Protecting Life S Next Steps The

Ensuring Your Path Solutions Protecting Life S Next Steps The

What You Need To Know About Long Term Care Insurance Family

What You Need To Know About Long Term Care Insurance Family

State Life Asset Care Ii Combination Life And Long Term Care

State Life Asset Care Ii Combination Life And Long Term Care

Add A A œlivinga Benefit To Your Clients Life Insurance Policies

Add A A œlivinga Benefit To Your Clients Life Insurance Policies

Long Term Care Rider Pros And Cons Is It Worth It

Long Term Care Rider Pros And Cons Is It Worth It

The Long Term Care Crisis Premiums Exploding Leaving Seniors

The Long Term Care Crisis Premiums Exploding Leaving Seniors

Top 10 Best Long Term Care Insurance Companies 2020 Update

Top 10 Best Long Term Care Insurance Companies 2020 Update

Axa Life Long Term Care Services Rider Shaw American

Axa Life Long Term Care Services Rider Shaw American

Long Term Care Ltc Rider Ppt Download

Long Term Care Ltc Rider Ppt Download

As Ltc Insurance Prices Rise Long Term Care Annuities Gain

As Ltc Insurance Prices Rise Long Term Care Annuities Gain

What Is A Long Term Care Rider Long Term Care Insurance

What Is A Long Term Care Rider Long Term Care Insurance

Long Term Care You Have Options The Bottoms Group

Long Term Care You Have Options The Bottoms Group

Considering Nationwide Carematters Ii Read Our In Depth Review

Considering Nationwide Carematters Ii Read Our In Depth Review

What Is A Long Term Care Rider Long Term Care Insurance

What Is A Long Term Care Rider Long Term Care Insurance

Long Term Care Insurance New Policy Choices By Jessica Johnson Issuu

Long Term Care Insurance New Policy Choices By Jessica Johnson Issuu

0 Komentar untuk "Term Life Insurance With Long Term Care Rider"