Term life insurance pros and cons overview. Term life vs whole life insurance.

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

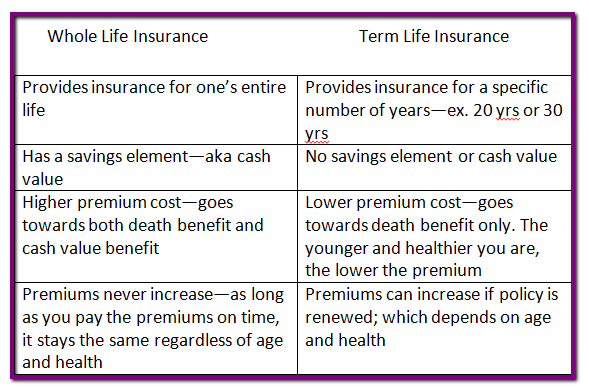

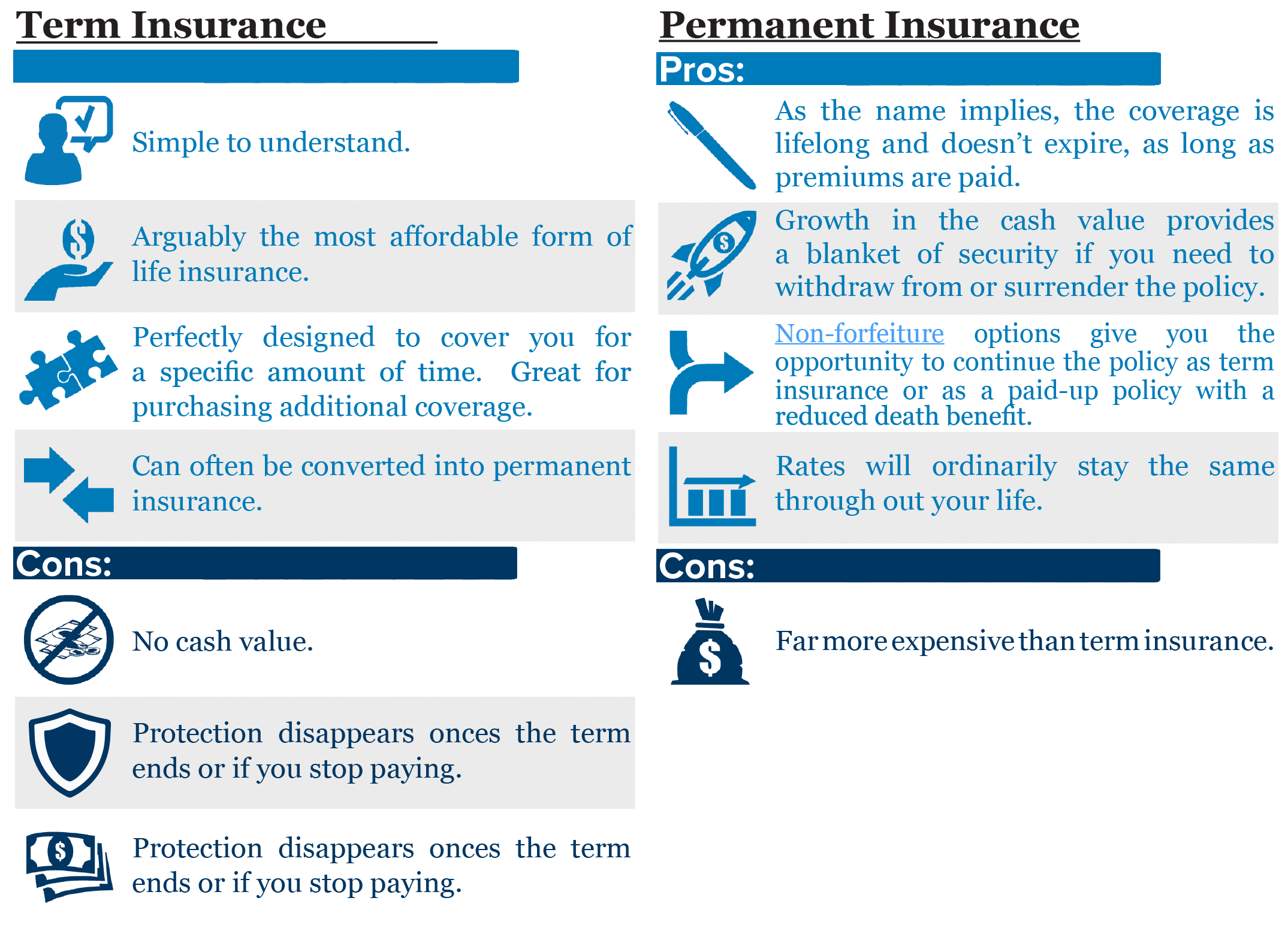

Term life insurance and whole life insurance are the two most common types of life insurance.

Term vs life insurance pros cons. It also ensures you a cash return and the returns are tax deferred like the other whole life alternatives. Therefore if you cannot afford the coverage you need with a permanent policy you can either. Life insurance pros and cons.

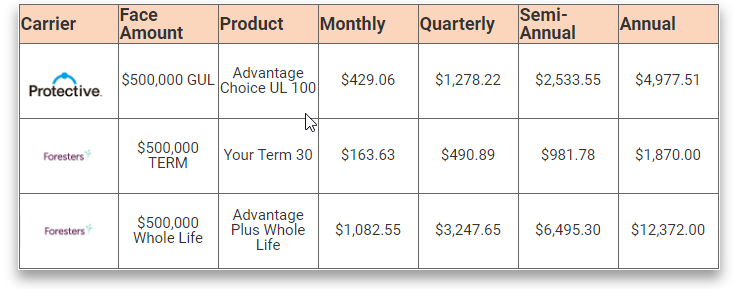

Term life is a temporary insurance policy that is less expensive has a higher face amount is harder to qualify for and has an expiration date. Which is best for you. Start with a term life insurance policy and convert it to a permanent policy at a later date or you can start with a combination of term and permanent life insurance.

20 year vs 30 year term life insurance the basic differences. Whole life insurance offers pros and cons but for most americans term life insurance is a better option. One of the differences between whole and term life insurance is the latter provides a death benefit without returning any cash value.

That means that they are pure life insurance. When deciding on the right life insurance coverage to help protect your loved ones weighing the pros and cons can help you narrow down your needs. There are no tax advantages for term life insurance.

Life insurance is a great way to protect your family not so much as an investment. Pros and cons term life and whole life insurance are both insurance policies that allow you to leave money to your beneficiaries after you pass. Whether you decide on a 20 year term or a 30 year both policies are basic term life insurance plans.

Unlike whole life insurance youre not paying for both life insurance and an investment provision. The pros and cons of term life insurance. Heres a quick guide to the pros and cons of term and whole life insurance.

Term life insurance is designed for temporary coverage without any of the bells and whistles that come with permanent policies. This is a benefit and disadvantage simultaneously depending on your financial objectives. Listed below are the pros and cons for each.

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Sell Life Insurance Policy For Cash 2020 Guide Magna Life

Etf Vs Mutual Fund Which Is Right For You Smartasset

Etf Vs Mutual Fund Which Is Right For You Smartasset

Pros And Cons Of Term Life Insurance Insurance Folks Free

Pros And Cons Of Term Life Insurance Insurance Folks Free

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide

What Is Vul Insurance And Should You Get One Moneymax Ph

What Is Vul Insurance And Should You Get One Moneymax Ph

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Non Guaranteed Vs Guaranteed Universal Life Insurance A Must Read

Limited Pay Whole Life Insurance

Limited Pay Whole Life Insurance

Answering Singaporeans Question Should You Cancel Your

Answering Singaporeans Question Should You Cancel Your

Bank Mortgage Insurance Moneywise

Bank Mortgage Insurance Moneywise

Term V S Whole Life Insurance Shields Insurance Agency

Term V S Whole Life Insurance Shields Insurance Agency

What S The Best Life Insurance Policy To Buy It S Healthy To Be

What S The Best Life Insurance Policy To Buy It S Healthy To Be

Life Insurance Or Sbp Asking The Right Questions Katehorrell

Life Insurance Or Sbp Asking The Right Questions Katehorrell

2020 Guide To Term Life Vs Whole Life Insurance Definition Pros

2020 Guide To Term Life Vs Whole Life Insurance Definition Pros

The Pros And Cons Of Permanent Life Insurance Vs Term Life

The Pros And Cons Of Permanent Life Insurance Vs Term Life

Term Life Insurance Pros And Cons Youtube

Term Life Insurance Pros And Cons Youtube

Term Insurance Premium Options Pros And Cons Of Paying Regular

Term Insurance Premium Options Pros And Cons Of Paying Regular

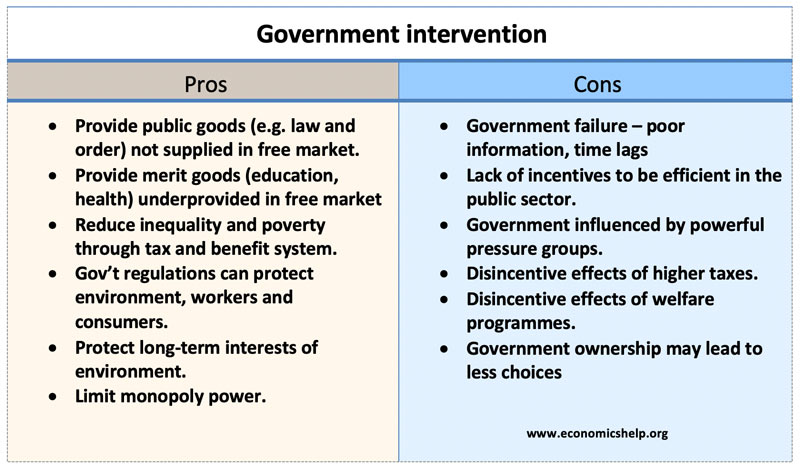

Pros And Cons Of Government Intervention Economics Help

Pros And Cons Of Government Intervention Economics Help

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How

/GettyImages-1005014082-9bc5937167a54ad0b546762d6de89ace.jpg) Indexed Universal Life Insurance Pros And Cons

Indexed Universal Life Insurance Pros And Cons

Aaa Insurance Exclusive Members Only Group Term Life Insurance Review

Aaa Insurance Exclusive Members Only Group Term Life Insurance Review

0 Komentar untuk "Term Vs Life Insurance Pros Cons"