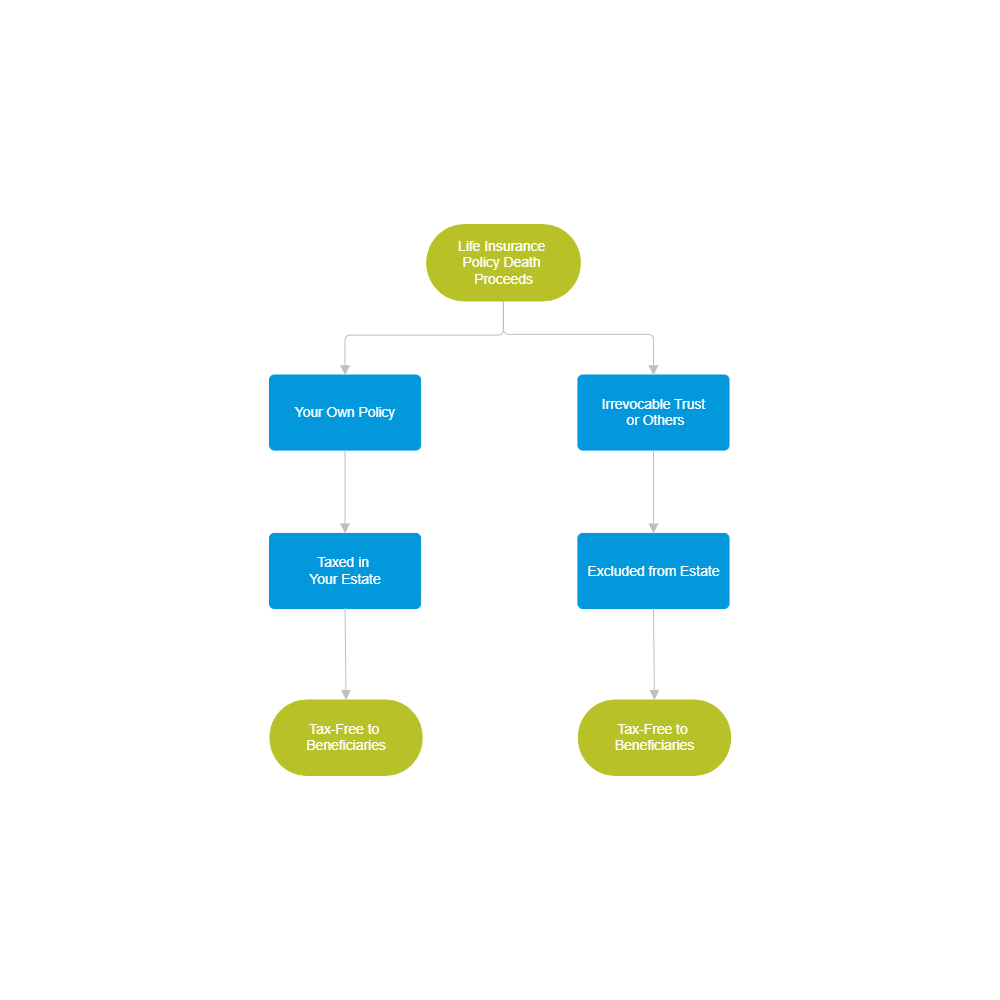

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. Most of the time proceeds arent taxable.

Life Insurance Companies To Sell Tax Security Insurance By

Life Insurance Companies To Sell Tax Security Insurance By

The 2017 tax law made changes to the estate tax.

Taxation on life insurance. Though as you can see taxation of other aspects of life insurance can be quite complicated. Learn how that affects your life insurance options here in most cases life insurance payouts are not taxable which is a huge benefit. Consult a tax or insurance professional if you require assistance with the tax treatment of your policy.

No sales tax is added or charged. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away. The premium cost for the first 50000 of life insurance coverage provided under an employer provided group term life insurance plan does not have to be reported as income and is not taxed to you.

While the contents this proverb is inevitable at least you can be reassured knowing that life insurance proceeds are paid out tax free. These premiums are also not tax deductible. Find out how to get tax free life insurance and compare quotes.

Life insurance premiums under most circumstances are not taxedie. But there are certain. However i believe the proceeds in this case may be taxed up to 35 if paid to non f.

One of the benefits of owning life insurance is the ability to generate a large sum of money payable to your heirs upon your death. An even greater advantage is the federal income tax free benefit. Life insurance helps make sure your loved ones are taken care of in the event of your death.

Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout. Our guide to life insurance tax outlines when tax is applicable to life insurance payouts. Employer paid life insurance may have a tax cost.

This tax free exclusion also. My client who has no spouse or dependents has a life insurance policy they own in their own name and has made their non dependent relative a binding nominated beneficiary in order for the proceeds to be not taxable.

Taxation Of Life Insurance Brian So Insurance

Taxation Of Life Insurance Brian So Insurance

Explanatory Notes For The Life Insurance Companies Taxation

Explanatory Notes For The Life Insurance Companies Taxation

Payroll Taxes And Employer Responsibilities

Payroll Taxes And Employer Responsibilities

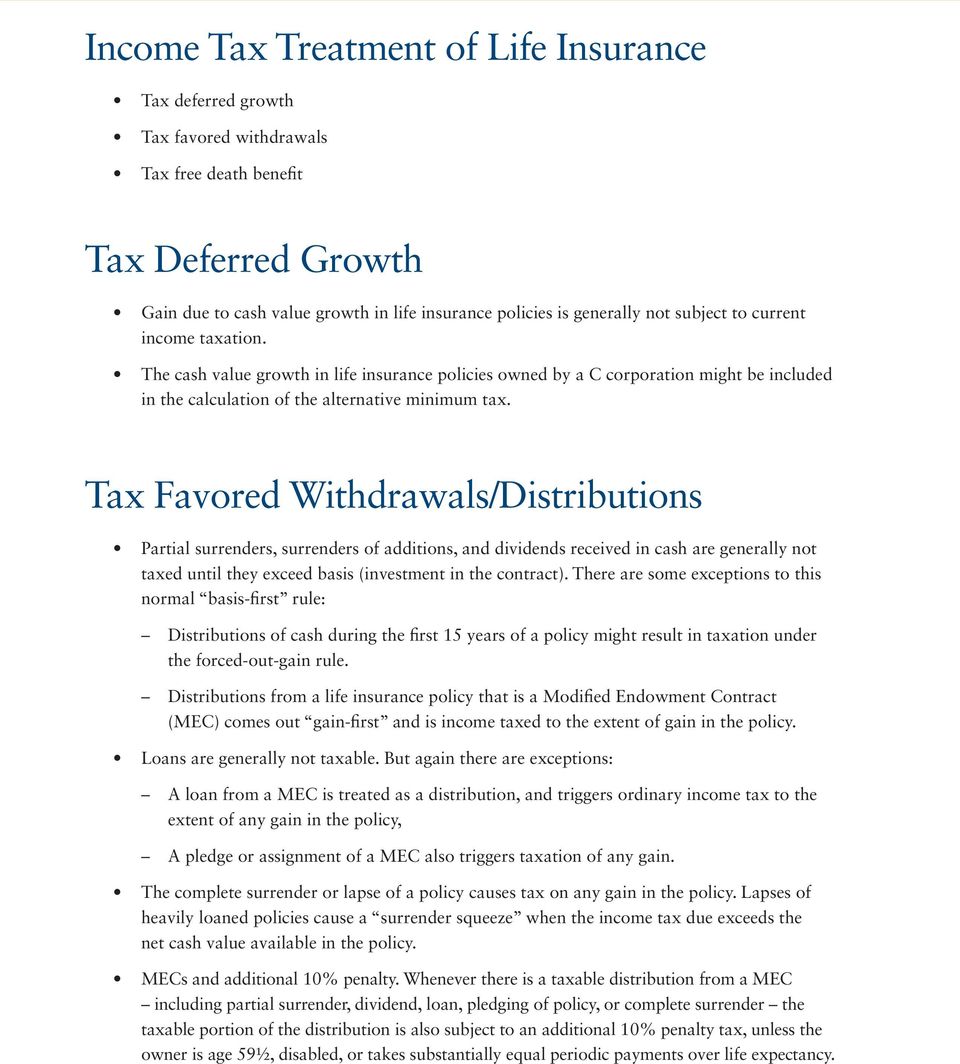

Life Insurance Income Taxation In Brief Pdf Free Download

Life Insurance Income Taxation In Brief Pdf Free Download

Do Beneficiaries Pay Taxes On Life Insurance Proceeds Insurance

Do Beneficiaries Pay Taxes On Life Insurance Proceeds Insurance

Ownership And Taxation Of Life Insurance Claims

Ownership And Taxation Of Life Insurance Claims

Taxes And Life Insurance Ambassador Advisors Llc

Taxes And Life Insurance Ambassador Advisors Llc

Not Full Amount But Only Difference Is Liable For Taxation

Not Full Amount But Only Difference Is Liable For Taxation

The Often Overlooked Income Tax Rules Of Life Insurance Policies

The Often Overlooked Income Tax Rules Of Life Insurance Policies

Capital Gains Tax And Life Insurance Policies In Business Wills

Capital Gains Tax And Life Insurance Policies In Business Wills

Philippines Life Insurance Income Before Taxes Gen Expenses

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Do Beneficiaries Have To Pay Taxes On Life Insurance In India

Do Beneficiaries Have To Pay Taxes On Life Insurance In India

How Is Life Insurance Money Taxed The Economic Times

How Is Life Insurance Money Taxed The Economic Times

Amount Received From Life Insurance Policies Its Taxation

Amount Received From Life Insurance Policies Its Taxation

The Tax Consequences Of Whole Life Insurance Nasdaq

The Tax Consequences Of Whole Life Insurance Nasdaq

A Study On Whether Taxation Is A Selling Tool For Life Insurance

A Study On Whether Taxation Is A Selling Tool For Life Insurance

Life Insurance Taxation And Benefits Life Insurance

Life Insurance Taxation And Benefits Life Insurance

Shift To Wealthier Clientele Puts Life Insurers In A Bind Wsj

Shift To Wealthier Clientele Puts Life Insurers In A Bind Wsj

Taxation Of Life And Health Insurance Riscario

Taxation Of Life And Health Insurance Riscario

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

0 Komentar untuk "Taxation On Life Insurance"