Estate tax advantages of permanent life insurance. Purchase a life insurance policy which you feel is suitable for you as it not only offers you protection but also offers tax benefits under section 80c of the income tax act 1961 and section 1010d of the income tax act 1961.

Know All The Tax Benefits Of Life Insurance Policies Before Buying One

Know All The Tax Benefits Of Life Insurance Policies Before Buying One

We will limit our discussion mostly to life insurance products.

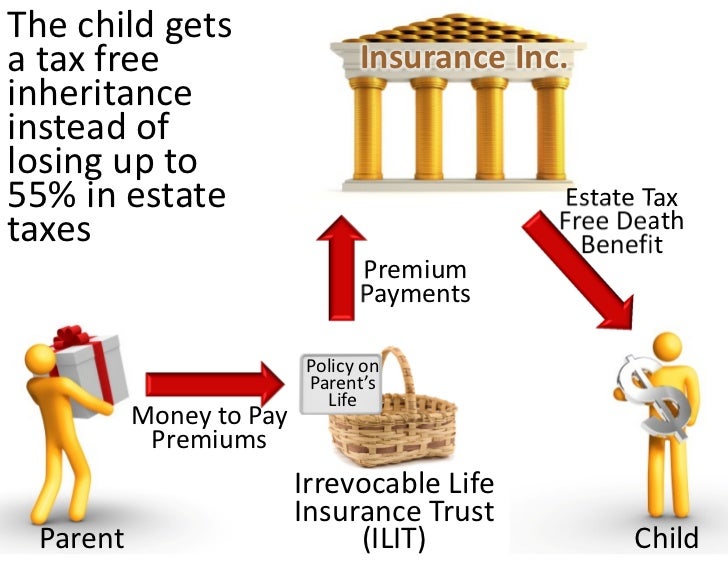

Tax benefits of life insurance. 2 income tax free distributions are achieved by withdrawing to the cost basis premiums paid then using policy loans. Tax advantages of life insurance living benefits this is where it really gets good. Life insurance is often used to provide liquidity to pay federal estate taxes.

No income tax on the premiums paid for life insurance. Here we will understand how this exemptions works and more importantly when they do not work. So if your life insurance plan has health related inbuilt or add on cover such as critical illness rider surgical care rider hospital care rider etc.

The money you get from selling your policy may be taxed. You can avail tax benefits. Life insurance settlement profits.

If you sell your life insurance policy the buyer will pay the premiums and receive the cash benefit upon your death. 1 proceeds from an insurance policy are generally income tax free and if properly structured may also be free from estate tax. Large number of individuals buy life insurance plans for the tax benefits they offer.

You get to avail these tax benefits under the income tax act 1962 in the form of deductions and exemptions. Term life insurance or permanent life may both be used for this purpose because the focus is the death benefit payable to the heirs. If you have permanent life insurancethe kind that builds cash value as opposed to term life insurance which has no cash valuethat cash value grows tax deferred until the policy is surrendered or you let it lapse.

Permanent life insurance policies provide death benefit coverage plus a cash value component that can allow the policyholder to build up a substantial amount of tax deferred savings over time. Here are some situations in which the government may claim a share of life insurance benefits. Loans and withdrawals may generate an income tax liability reduce available cash value and reduce the death benefit or cause the policy to lapse.

When is life insurance taxable. By giving you a set of options to plan your retirement savings and investments most life insurance policies help you save a lot of tax in the process. Under section 80d of the income tax act 1961 allows tax benefits on health insurance premium.

Life Insurance 3 Income Tax Advantages Geminired Virtual Services

Life Insurance 3 Income Tax Advantages Geminired Virtual Services

Are You Aware Of The Tax Benefits Of Life Insurance

Are You Aware Of The Tax Benefits Of Life Insurance

Life Insurance And Its Tax Benefits Explained

Life Insurance And Its Tax Benefits Explained

Advantages Of Buying Insurance Early Hdfc Life

Advantages Of Buying Insurance Early Hdfc Life

What Are The Benefits Of Buying Life Insurance Quora

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

Do I Have To Pay Taxes On Life Insurance Payouts Life Insurance

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

Income Tax Benefit On Life Insurance Section 80c 10d Hdfc Life

What Are The Major Benefits Of Life Insurance Steemit

What Are The Major Benefits Of Life Insurance Steemit

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

Life Insurance With Financial Protection And Tax Benefits

Life Insurance With Financial Protection And Tax Benefits

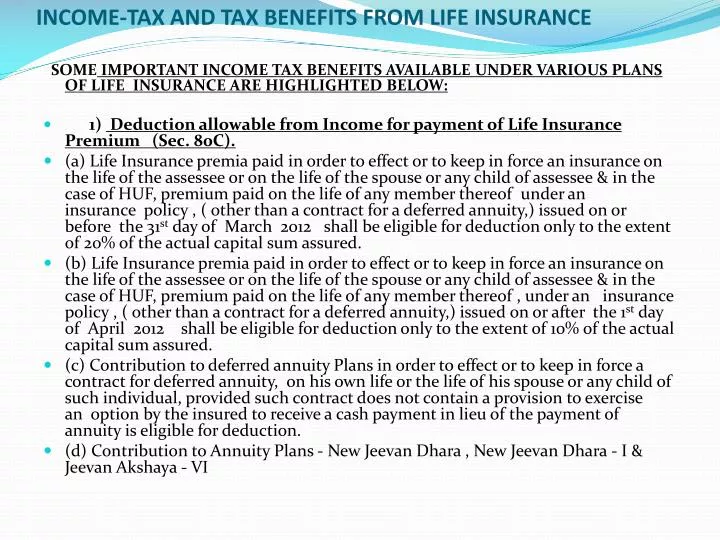

Financial Planning Taxation Final Authorstream

Financial Planning Taxation Final Authorstream

Ppt Income Tax And Tax Benefits From Life Insurance Powerpoint

Ppt Income Tax And Tax Benefits From Life Insurance Powerpoint

I Am Looking For A Good Insurance Plan But Want To Know More About

I Am Looking For A Good Insurance Plan But Want To Know More About

Life Insurance Charitable Remainder Trusts

Life Insurance Charitable Remainder Trusts

Term Insurance Tax Benefits How To Get Tax Benefits On Life

Term Insurance Tax Benefits How To Get Tax Benefits On Life

3 Advantages Of Corporate Owned Life Insurance Nick Godfrey

3 Advantages Of Corporate Owned Life Insurance Nick Godfrey

Is Life Insurance Tax Deductible Einsurance

Is Life Insurance Tax Deductible Einsurance

Do You Know All The Tax Benefits Of Your Life Insurance Policy

Do You Know All The Tax Benefits Of Your Life Insurance Policy

Read All About Life Insurance Tax Benefits

Read All About Life Insurance Tax Benefits

Tax Benefit For Life Insurance Premium And Maturity Amt

Tax Benefit For Life Insurance Premium And Maturity Amt

Everything You Must Know About Tax Benefits Of Medical And Life

Everything You Must Know About Tax Benefits Of Medical And Life

New Children S Money Back Life Insurance Quotes How To Plan

New Children S Money Back Life Insurance Quotes How To Plan

Do You Know All The Tax Benefits Of Your Life Insurance Policy

Do You Know All The Tax Benefits Of Your Life Insurance Policy

0 Komentar untuk "Tax Benefits Of Life Insurance"