Now i will help you with the different types of life insurance riders through this article. What are riders in insurance.

Mortality Risk Management Individual Life Insurance Ppt Video

Mortality Risk Management Individual Life Insurance Ppt Video

Life insurance comes in many forms including term life insurance whole life insurance unit linked investment plans ulips endowment policies etc.

Riders in life insurance. This is where life insurance riders come to your rescue. A life insurance plan is critical in the sense that it provides protection to an individuals family in the event of hisher untimely demise. A rider is also referred to as an insurance endorsement.

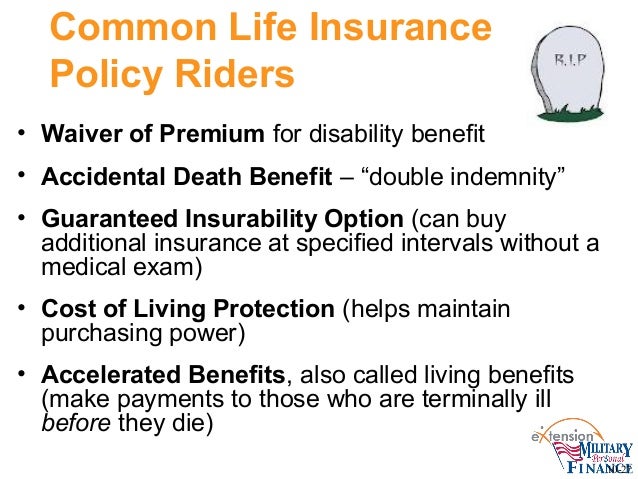

Riders vary by life insurance provider and policy type. You can cover these unforeseen eventualities with rider sum assured benefits. A standard life insurance policy may or may not fill all of your coverage needs.

Riders benefits can be availed at additional costs depending on your present and future insurance needs. Additional smaller policies can be purchased which will pre pay or provide a specific death benefit amount to pay for the cost of your funeral. They offer financial cover over and above basic sum assured in a life insurance policy.

Riders are the valuable tools that help you in expanding your life insurance coverage. Using life insurance riders to pay off debt. A life insurance rider is an additional feature added to a life insurance policy.

Even with the occurrence of the event the life cover remains intact. The cost of each rider will depend on many factors such as the type of policy and your health and age. Life insurance riders are features not found on a basic life insurance policy and may provide benefits to the owner or beneficiaries of.

It can be added to policies that cover life homes autos and rental units. Life insurance riders can be used in a variety of ways to pay off your existing debts. A guaranteed insurability rider lets you buy extra insurance.

Life insurance riders are contingent additional benefits over a primary policy which come into play in case of a specific eventuality. Funeral and burial insurance rider. Riders in life insurance are addon benefits that can be added to your policy.

What are the different life insurance riders. Riders are the extra benefits that a policyholder can buy to add on to a life insurance policy. Riders are add ons or additional benefits which you can opt for along with your current life insurance policy at affordable rates.

By adding riders to your life insurance you can expand the policys coverage at very low premiums. The most common are described below. A rider is a legal term meant to denote an amendment change or addition to a legal contract.

Life insurance riders can be used to fill any coverage gaps to address specific concerns you may have.

How To Customize Your Life Insurance Policy With Riders

How To Customize Your Life Insurance Policy With Riders

Video Maximize Your Life Insurance With Riders Accuquote

Video Maximize Your Life Insurance With Riders Accuquote

Your Guide To Waiver Of Premium Riders In Life Insurance

Your Guide To Waiver Of Premium Riders In Life Insurance

Life Insurance What Pfmp Staff And Military Families Need To Know

Life Insurance What Pfmp Staff And Military Families Need To Know

What Are Policy Riders With Life Insurance Quora

8 Life Insurance Riders You Need To Know About

8 Life Insurance Riders You Need To Know About

Life Insurance Riders Wealth Guardian Group Insurance

Life Insurance Riders Wealth Guardian Group Insurance

Types Of Life Insurance Life Insurance Policy Characteristics

Types Of Life Insurance Life Insurance Policy Characteristics

What Is A Living Benefits Rider For Life Insurance Largo

What Is A Living Benefits Rider For Life Insurance Largo

5 Reasons To Buy 500 000 No Exam Life Insurance Instant Quotes

5 Reasons To Buy 500 000 No Exam Life Insurance Instant Quotes

Your Guide To Choosing Effective Life Insurance Riders

Your Guide To Choosing Effective Life Insurance Riders

Learn How Riders Enhance Your Ulip Policy Bajaj Allianz Life

Learn How Riders Enhance Your Ulip Policy Bajaj Allianz Life

Available Riders Kotak Life Insurance Kotak Mahindra

Available Riders Kotak Life Insurance Kotak Mahindra

How Riders Can Make Your Life Insurance Cover More Beneficial

How Riders Can Make Your Life Insurance Cover More Beneficial

Riders In Term Life Insurance Features And Benefits Hdfc Life

Riders In Term Life Insurance Features And Benefits Hdfc Life

Make Your Life Insurance Policy More Robust With Riders

Make Your Life Insurance Policy More Robust With Riders

Life Insurance Riders See The Top 13 Policy Riders Now

Life Insurance Riders See The Top 13 Policy Riders Now

0 Komentar untuk "Riders In Life Insurance"